In the financial industry, the loan approval process is critical for determining whether applicants qualify for credit. However, data quality plays a pivotal role in ensuring the accuracy and integrity of this process. Poor data quality can lead to misinformed decisions, financial losses, and heightened risks for both lenders and borrowers. Financial institutions rely heavily on accurate, complete, and timely data to assess an applicant’s creditworthiness and mitigate risk.

Key Challenges:

- Incomplete or Inaccurate Data:One of the primary challenges in loan approval processes is handling incomplete or inaccurate applicant information. Missing data on income, credit history, or assets can result in faulty credit risk assessments. 22% of all loan applications contain errors due to missing or inaccurate information, delaying approval or causing rejections .

- Data Integrity:Ensuring the integrity of the data over time is crucial. Poor data governance often leads to discrepancies between historical records and real-time data, resulting in inconsistent risk assessments. Maintaining data integrity across multiple platforms and systems is a major issue for large institutions with outdated IT infrastructures .

- Legacy System Integration:Many banks still operate on legacy systems that are incompatible with modern data analytics tools. This results in delays in aggregating and verifying data from multiple sources, negatively impacting decision-making. The integration of machine learning tools that automate data validation can significantly enhance this process .

- Regulatory Compliance:Compliance with standards like the Basel III Framework and the Dodd-Frank Act requires accurate data reporting for risk assessments and stress testing. Poor data quality can lead to non-compliance, hefty fines, and a loss of trust. Ensuring real-time updates and accurate data reporting has become increasingly challenging with constantly changing regulations.

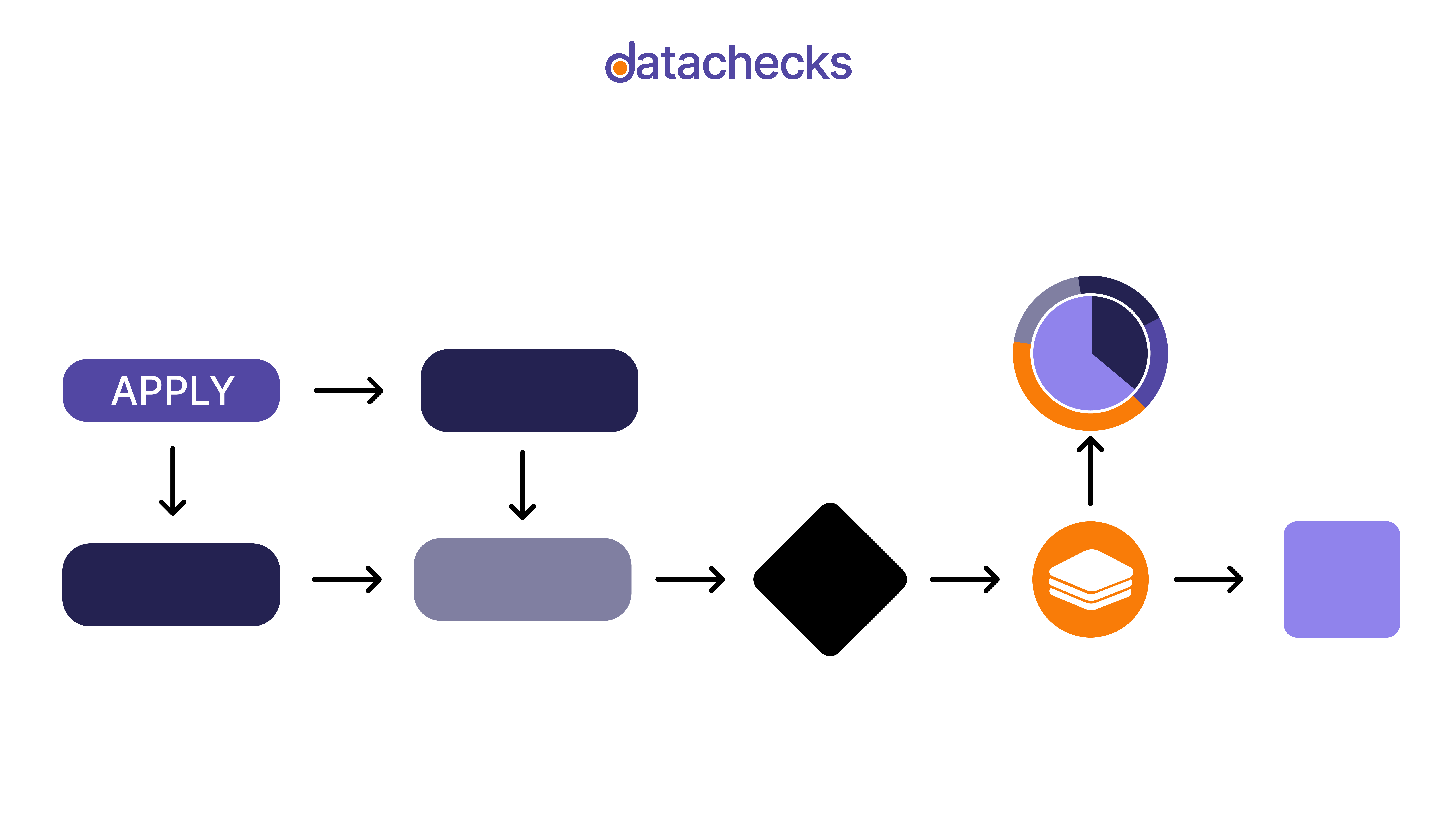

Experts at Datachecks suggest that integrating data governance frameworks and leveraging artificial intelligence (AI) can automate the data validation and verification processes, minimizing human errors. According to a 2023 study on loan approval systems, ML-based systems reduce approval time by 50% while improving credit risk assessment by 23% .

By investing in data quality management and adopting emerging technologies, banks can streamline their loan approval processes, reduce risks, and remain compliant with regulatory requirements. High-quality data not only drives better decision-making but also enhances customer trust and satisfaction.